In past rants the Redneck Economist has warned about the American economy being affected by outside forces beyond the control of the U. S. Federal Reserve Open Market Committee (FOMC) or actions taken by the U. S. Congress. I work hard at trying to present known facts and not my opinion. There are links here on the website to support the facts presented in the rants. Presently, we are experiencing inflation at rates not seen since the 1970’s.

I hate to use the phrase “history will repeat itself” but it is true. In the 1960’s the U. S. Congress past massive spending legislation like expanding Social Security benefits, instituting Medicare and Medicaid, the Federal free lunch program (then intended only for the impoverished), Federal Head Start, raising the minimum wage (covered in previous rants) just to name a few. The result of this increase in Federal spending was growing inflation. Hold onto your hats. The FOMC under Paul Voelker raise the Federal Funds Rate to unprecedented eighteen percent (18%). We are at one percent (1%) today. We are led to believe by the media that the cause of the current inflation at around eight percent (8%) has been caused by restrictions by the current Presidential Administration on the oil and gas industry; canceling the XL piping from Canada to Texas, restricting drilling on Federal land and issuing offshore drilling permits and the ware in Ukraine with the price of gasoline rising from a national average of around $2.50 a gallon in January, 2021 to $4.72 today.

Well, let’s take at look at the facts. One important fact is the number of oil refineries in the United States. It is reported by U. S. Energy Information Administration (EIA) there are 124 operating refineries today in the U. S. and 5 idle units. This compares to 131 operating refineries in 2020 with 4 idle units. In 2020-2021 timeframe, 6 units were decommissioned.

The newest refinery with significant downstream unit capacity is Marathan’s facility in Garyville, Louisiana. That facility came online in 1977 with a refining capacity of 578,000 barrels per calendar day. Five (5) other units were constructed primarily in Texas between 2015 and 2017 with refining capacities of only 246,500 barrels per day. Motiva upgraded its unit in Port Arthur, Texas and reported a capacity of 607,000 barrels per calendar day as of January 1, 2021. Valero upgraded its Corpus Christi, Texas unit to 290,000 barrels per calendar day also as of January 1, 2021. All information presented can be found at eia.gov. Below is a chart from the website.

We see there has been a drop in refining capacity of 829,386 barrels per calendar day from 2020 to 2021. Why did that happen? Fuel demand certainly dropped in 2020 due to the COVID lockdowns. The price of oil two years ago dropped to less than $10 a barrel. Why? There was no place to go with the excess. Gasoline tanks were full. Now they are not. So, doesn’t it appear our gasoline price spikes in the last year is not the result of not enough oil, but on a decreased refining capacity in the United States. Seems the thing happened this year with baby formula. The plant producing 40% of the supply shutdown operations earlier this year.

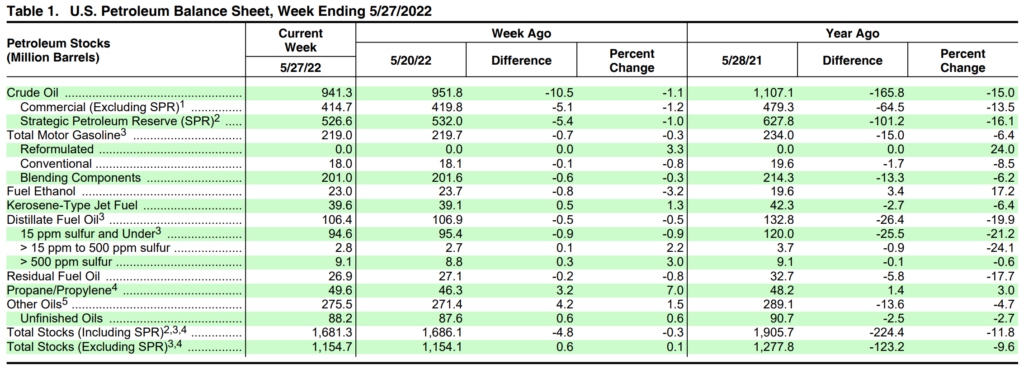

Take a look at other facts from the EIA. You can check out the EIA website and find this chart. It is called the U.S. Petroleum Balance Sheet. It is published weekly and has history back for decades.

This chart shows the U.S. Crude Oil stocks are down 165.6 million barrels from this time last year. It shows motor gasoline stocks are down 15 million barrels from this time last year. We also see a loss of 101.2 million barrels from the Strategic Petroleum Reserve (SPR) from last year.

However, look at the Petroleum Supply data. We see that domestic production is up 8.1 million barrels a calendar day from last year. We also see we are now importing 7.9 million barrels more today than one year ago. Wait though. We are now exporting an average of 9.5 million barrels per day than one year ago. The crude oil input to refineries is up 8.7 million barrels from this time last year.

Does any of this explain why gasoline prices are at $4.71 per gallon today? Seems we are producing more oil than we were one year ago. We are exporting more oil today than one year ago. We are also importing more oil and drawing down the SPR. Why is this happening? Well, the Redneck still believes in the theory of supply and demand on prices. It is obvious demand for transportation fuels for our cars, 18 wheelers hauling our food, trains doing the same, and airplanes flying us around is hugely up while the capacities of our refineries (supply) is down.

I want to emphasize again that this is not a political website or a political rant. The U. S. has to address our ability to refine our fuels. Without refining capacity we will not be able to fuel the expansion of our economy. We also need the pipelines to get the product from the field to the refinery. It appears to me that we are going to see continued inflation in all areas of our economy and life for several years. Any action by the FOMC in raising interest rates will only increase the probability of a recession leading to unemployment, business failures, and collapses of institutions across the country.

I encourage you to read my rant about the effects of inflation on tax collections. The only entity that wins during inflationary times is government. Remember, I am just a redneck.

The Redneck Economist

June 8, 2022