Inflation and Taxes

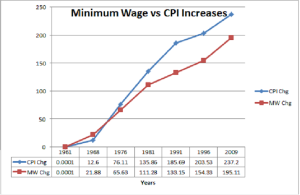

This rant will discuss the impact inflation has on tax revenues of the Federal, State and local governments. Your first reaction will be “how can inflation impact the amount of taxes governments collect?” Hopefully, this rant will illustrate the point. In the earlier rant titled “The Minimum Wage and Inflation” we illustrated that increases in the Federal minimum wage rate over the last 50 years has resulted in an overall increase of 237 points in the Consumer Price Index (CPI). This means that something that cost $1.00 in 1960, would now cost $7.49 according to the Federal Bureau of Labor Statistics. The following graph shows the comparison of the increases in the minimum wage rate and the increases in the CPI.

Let’s make some basic assumptions to illustrate the end result — governments collect more taxes because of inflation. Bob works as a machine operator in a chemical plant somewhere in the heartland of America. It is 1961, and Bob is preparing to file his income tax return for 1960. Bob makes well above the Federal minimum wage rate of $1.00 per hour. When Bob finishes calculating his taxable income and the amount of income tax he owes, he finds he has taxable income after personal deductions of $8,000. Bob also finds he owes $1,680 in Federal income tax. He is happy that his employer withheld $1,700 during the year, so he will get a $20 refund. Bob and his family end the year with $6,320 in after tax spendable income, not counting Bob’s social security tax.

For 2013, using the Bureau of Labor Statistics CPI Inflation Calculator, Bob will find he should have $57,500 in taxable income to have the same after tax spendable income in 2013, that he earned in 1960. Bob and his family will pay $7,736 in Federal income tax. In 2013, Bob will pay $6,056 more Federal income tax than he paid in 1960, doing the same job. This does not consider the increases he has paid in social security and medicare taxes. However, the Federal government has collected 360% more income tax revenue from Bob’s efforts.

The Redneck Economist attempts to keep things simple so folks like him can understand why we have gotten ourselves into the mess we are in right now. There are those educated economist that have developed macro analysis of the impact of inflation induced by the simple increase in the minimum wage on tax revenues, domestic gross nation product, and the compound effect of these continuing increases on the increasing number of families in or near the poverty level in the United States. The information and data is at our disposal on government websites. The bureaucrats and politicians do not explain what the real reason is behind most of their proposals and plans.

Let’s take a quick look at what President Obama’s proposal to raise the minimum wage rate from $7.25 an hour to $10.10 an hour will have on just social security and medicare taxes. Remember, minimum wage earners must pay their share of these taxes while their employers pay their share. Currently, both employee and employer pay an equal amount (7.65% for the employee, and 7.65% for the employer.)

Follow this calculation. The payroll taxes (social security and medicare) on the $2.85 proposed increase in the minimum wage rate amounts to $ 43.6 cents per hour. Assuming an employee works 40 hours a week, 52 weeks a year, the employee and his employer will pay $906.84 more in payroll taxes. Assume also, there are five million Americans making the current $7.25 minimum wage rate. The US Treasury will collect $4.535 billion more in payroll taxes each year. It is been proven over time that the increase in the minimum wage rate also drives the wages of all Americans higher. It is also known that many small businesses cannot meet the demands for higher wages or pay higher payroll taxes and remain in business.

In addition to Federal income and payroll taxes we all pay, the higher minimum wage affect on increase cost of living will result in higher state and local taxes such as sales tax and property taxes. As we all know, this leads to bigger government and more government spending resulting in a increase in spiraling government debt.

The Redneck Economist