The Minimum Wage vs Inflation

In 1938, the US Congress passed the 1938 Federal Minimum Wage Law. The law established, for the first time, a minimum wage of $0.35 per hour for all workers employed by companies engaged in interstate commerce. Congress amended the law during the 1940’s and 1950’s several times by increasing the rate to $1.00 per hour by 1960. Following numerous lawsuits to define “Interstate commerce,” the law was amended in 1961 to include workers of large retail and service enterprises, local transit, construction, and gasoline station employees at the same rate of $1.00 per hour.

Since 1961, the law has been amended six (6) times to increase the Federal minimum wage. The six amendments were signed into law by three (3) Democratic Presidents and three (3) Republican Presidents. In 1978, the law was amended to include all workers . There are still a few classes of workers that are exempt, like children under the age of 19 working for the parents. Today, the Federal minimum wage is $7.25 per hour.

The question we want to explore in this paper is which greyhound is chasing the rabbit – do increases in the minimum wage rate cause inflation, or is the minimum wage increased because of inflation. When the law was passed in 1938, it was done so following pressure from labor unions in the automotive, manufacturing, steel, and transportation industries to assure workers in those industries a guaranteed wage. Today, the argument for increasing the minimum wage is based on maintaining a family income at the “US poverty level.” You will see in the supporting graphics that inflation and the cost of living have increased continually following amendments to the law increasing the minimum wage rate. Which dog is chasing the rabbit? Further increases in the Federal Minimum Wage will drive a bigger wedge between those that have and those that don’t.

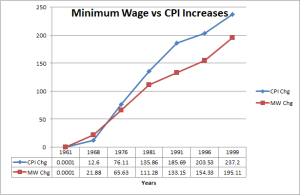

The chart below illustrates the percentage increases of both the Federal Minimum Wage and the Consumer Price Index, one measure of the rate of inflation.

The US Congress is studying the actions by President Obama to increase the minimum wage rate to $10.10 per hour, an increase of $2.85 or 39.3%. We believe this will cause a rapid increase in inflation forcing the middle income Americans at the lower end of the income scale into poverty levels and those currently in the poverty level further into financial distress.

The effect of inflation on our economy and the economies of the world is disastrous. Before the rate increases in 2007, one could buy their favorite hamburger, fries, and drink for around $5.00. Today, the average price of the same hamburger ranges from $7.50 to $8.50. Why has the cost increased? Because most of the employees in those business are paid at or near the minimum wage. The Bureau of Labor Statistics has a CPI Inflation Calculator at www.bls.gov/data/inflation_calculator.htm. It calculates the buying power of $1.00 at some time in history to 2013.

One can relate the increases in most consumer goods to the same reason. Other examples are: a grocery store clerk that stocks the shelves; cleaning staffs at hotels; janitorial staffs in office buildings, your local laundry, security guards at airports, factories, and public buildings and on and on. Increasing the minimum wage rate raises the cost of everything we use in our daily lives. Does one think the grocery store is going to hold the price of its goods, while paying its employees the higher wage? Non-luxury hotel room rates five years ago ranged from $39.95 to $69.95 per night across the nation. Today, the rate at the same hotels range from $89.95 to $129.95. Why?, increased cost of operations caused by the 2007 increases in the minimum wage rate.

There are those in Washington that know the simple truth. If the government can cause inflation by increasing the minimum wage the cost of everything goes up. Inflated cost and revenue amounts cause the appearance of growth in the economy when in reality we produce less. One end result of lower production is less jobs. The other result is governments at all levels collect more taxes. We will explore the effect of inflation and increasing the minimum wage on tax revenues in our next rant.

The Redneck Economist