We discussed the role of the Federal Open Market Committee (FOMC) near the end of Part 2. If you didn’t read Part 2, the FOMC is a committee of the Federal Reseve Bank. The members are the 7 members of the Board of Govenors of the Federal Reserve System and 5 members chosen from the 12 Regional Federal Reserve Bank Presidents. The Chairman of the FOMC is the public spokesperson for the Committee.

The FOMC’s mandate from Congress includes three important activities; (1) take action to maintain full employment in the economy of the United States; (2) monitor the financial liguidity of US banks; and (3) to assure the US Economy has sufficient cash and credit to maintain a strong, growing economy.

Until the mid-1950’s, the FOMC could effectively manage the amount of credit in the US Economy by providing or retracting credit to member banks. In the mid-1950’s, large US corporations started issuing credit cards and making credit services available directly to their customers outside the banking system. Credit card companies emerged in the 1960’s making credit available to consumers regardless of their ability to pay. In our opinion, the FOMC lost control of the amount of credit available in the US Economy. It has attempted to maintain some control over credit by munipulating interest rates offered to member banks and the credit community. Since the financial crisis of 2008, the FOMC took action to stimulate the economy by purchasing bonds through the bond markets to the tune of $85 billion a month. This action put cash immediately back into the credit markets. What is not known by us rednecks is the financial strength of the companies, governments, and agencies that owe the debt now to our Federal Reserve System.

We need to look at the history of action by the FOMC to see what “real” effect the Committee’s actions had on our financial system. In July, 1990, the FOMC set the Fed Funds rate at 8.00%. Interest rates on US Treasury Bonds and Notes were running between 12.00% and 15.00%. The country was realing from the financial collapse of the Savings and Loan industry. Savings and Loan institutions were chartered much like banks. There were federal and state chartered instutions created to provide federally insured savings accounts to Americans. The savings account deposits were then used by the instiutions to make mortgage loans to home buyers. The deposit accounts in the institutions were insured by the Federal Savings and Loan Insurance Corporation (FSLIC) on the same basis as the FDIC insures bank deposit accounts. The S & L industry collapsed due to major changes in the Tax Reform Act of 1986. The unemployment rate in 1990 was 5.5%.

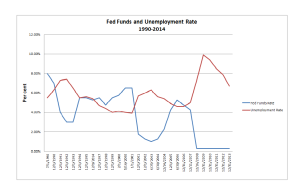

Mortgage interest rates were in the mid-teens. President Reagan and President George H. W. Bush, at the time, recognized the cost of the US debt was impacting the US economy. In 1987, President Reagan appointed Alan Greenspan to be Chairman of the Board of Governors of the Federal Reserve System and Chairman of the FOMC. Mr. Greenspan began to promote lowering the Fed Funds rate in an effort to reduce the cost of interest on the National Debt. By December, 1991, the FOMC had lowered the rate to 4.00% and to 3.00% by the end of 1992. During this time period the unemployment rate rose to 7.4% by the December, 1992. In late 1993 and early 1994, the unemployment rate dropped back to 5.5% and the FOMC deemed the economy was in fact recovering and needed to take action to keep inflation in check while trying to control the volume of credit invading the economy from non-banking entities. By December, 1994, the Committee raised the rate to 5.50% and maintained the rate at that level through 1999. The U.S. Economy continued to improve with the unemployment rate falling to 4.0% by December, 1999. The chart below shows the level of unemployment compared to the Fed Funds rate from 1990-2014.

Chairman Greenspan was highly concerned about the rate of inflation in 1999 while the world awaited the transition into a new millenium. In 2000, Greenspan convinced the FOMC to raise the Fed Funds to 6.5% and kept the rate at that level through the first half of 2001. In the Fall of 2001, we experienced the attack on the World Trade Center. Shortly after, several large American corporations gave notice they were bankrupt, namely Enron, WorldCom, Global Crossings, Tyco International, Adelphia Communications along with 16 others.

Was their failure due to incompetent and/or corrupt management or because of actions by the FOMC. These large corporations were required by the Federal Securities and Exchange Commission to maintain their financial records on the “mark-to-market” accounting method. The “mark-to-market” accounting method requires that any negoitable security be valued on the books of the company based on the contracts market value. Well, in the mid-1990’s while the Fed Funds rate was in the 3.00% to 4.5%, Enron and the other companies entered into long-term contracts for gas, water, electricity, and other commodities. So, if one buys a long-term contract based on the current interest rate for say $10,000, and the interest rate goes up, the value of the contract goes down in market value. When the interest rate in the mid 1990’s went from 3.00% to 6.5%, that meant the value of a contract purchased in the 1995 would be worth around 50% of its face value in 2001. These corporations had to write down their assets because of an accounting method, not because the contracts were not viable. The same principle holds true for bonds, notes, and mortgages.

Why did we have a near financial collapse in 2001-2002? The Redneck believes it was due to the FOMC raising the Fed Funds rate by more than 200% in 5 years. How did Greenspan react? The FOMC lowered the Fed Funds Rate by the end of 2001 to 1.75% and to 1.00% by the summer of 2003.

Mr. Greenspan retired in 2004, and Bernard Bernacke took over as Chairman of the Board of Governors and the FOMC. Mr. Bernacke came into office with the expressed goal of raising the Fed Funds rate at least .25% each quarter to hold down the rate of projected inflation which at time was around 2.5-3.0%. By the summer of 2006, Mr. Bernacke and the FOMC had raised the rate to 5.25% from the 1.00% in June, 2003. This resulted in the increase of 425.00%. I hope by now you are getting the picture.

The mortgage loan made by the Federally insured mortgage loan company got devalued by 425.00%, even though in many cases the borrower continued to make his monthly payment. The bank though had to write down the value of the mortgage on its books by 425.00%. No wonder we had a financial system collapse in 2009.

What did Mr. Bernacke do because of the 2009 financial crisis? He and the FOMC immediate took action to lower the Fed Funds rate to .25% or by 525%. Why dd Citibank, JP Morgan, Bank of America, and smaller banks like Wellsfargo immmediately, in late 2010 andd 2011, report substantial earnings? Because they were able to adjust the carrying value of those mortgages back up erasing the loses they had recorded the previous year. Smaller banks and other financial institutions like Merrill Lynch, Countrywide Mortgage Co., and Lyman Brothers, never got the chance because of forced takeovers or closures by the Federal government. GMAC, the financing company of the General Motors, and American Express, converted to be banks. Why, to take advantage of the mark-to-market accounting rules for banks and to receive part of the billions of dollars poured into the banking system by the economic stimulus packages passed by the US Congress.

Is the Federal Reserve Bank and the Federal Open Market Committee really looking out for our best interest or is it our worst enemy? We will discuss the expectation for the future in Part 4.

The Redneck Economist, April, 2014