Adam Smith in the first edition of “Wealth of Nations” published in 1776, wrote (and I paraphrase): “Business leaders will adjust to the supply and demand forces of their economy. What those business leaders cannot do is adjust their business activity because of changes in taxes or interest rates.” In Part 3, we attempted, in our limited way, to demonstrate that the Federal Open Market Committee (FOMC) raised and lowered the Fed Funds rate over the past 30 years in response to a “hot and “cold” US economy. The “hot” and “cold” condition of the US economy during this time period was generally caused by laws affecting US businesses through the Internal Revenue Code, adjusting the tax structure, or by new regulations imposed by Congress. The affect of those rates changes had significant, damaging impacts to the US Economy.

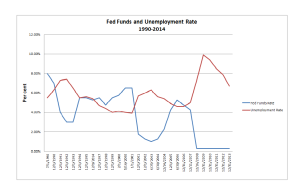

The following chart compares the Fed Funds rate to the US Unemployment rate:

It is clear that the spread between the Fed Funds rate decreases and the unemployment rate increases have widened during each recessionary period -1990 to 1993; 2001 to 2005 and currently, 2009 to the present. Each recessionary period has increased in length. We discussed actions taken by the FOMC in 2009, in response to the collapse of the financial markets. First, the FOMC immediately lowered the Fed Funds rate from 5.25% to .25%. In addition, the FOMC began a program of purchasing bonds and other long-term financial instruments through the financial markets at a rate of $85 billion per month. In February, 2014, the FOMC took action to reduce the monthly purchases by $10 billion a month.

Janet Yellen replaced Bernard Bernacke as Chairman of the Board of Governors of the Federal Reserve System in March, 2014. At her first news conference (watch under tab – Federal Reserve Bank on the right hand side) announced the FOMC would not use a previous benchmark set by Chairman Bernacke of an unemployment rate dipping below 6.5% as a trigger for raising the Fed Funds rate. Chairman Yellen said the FOMC would consider the unemployment rate dipping below 6.5%, but that was not going to trigger automatic increases in the Fed Funds rate at the present time. The stock market hit record highs following her comments.

The redneck believes that if we had a deep recession in 2001-2004 because of a 200% increase in the Fed Funds rate and then a 425% increase between 2004-2008 resulting in the major recession starting in late 2008 and continuing today, any increases in the Fed Funds rate will be more damaging to the US financial markets and our banking system than the deep depression of the 1920’s.

We cannot predict the outcome of any rate increases other than minor increases of 100 basis points or less for any foreseeable future. The carrying cost of the expanding National Debt will be catastrophic not to mention the probable failure of our banking system. The FOMC and the US Treasury will not be able to borrow enough money to bailout a future failure.

What can rednecks do? Our recommendation is if you have your savings in the equity markets have a “sell out” plan when you have a sense that a collapse of the markets is near. If you have a 401k or other retirement plan, demand that the Trustee of the plan also have a plan to bail out. Consider putting some of your excess cash into a real estate investment, preferably income producing real estate like row crop farm land or rent houses. While this redneck does own gold and silver, we only have about 15% of our net worth in precious metals. We approach buying precious metals like taking a Caribbean cruise. Buy it, then put in a safe place, and forget you have it hoping you will never have to use it.

Be vigilant. Don’t just assume you are safe and the government and politicians will take care of you. Check back with us for updated information. What should we watch for? When the FOMC starts increasing the Fed Funds rate we consider it as the sign that bad things will happen sometime in the near future. If Congress approves an increase in the minimum wage, expect inflation to follow. Washington will again figure out a way to change how inflation is calculated, just like they did twice in the last 30 years to make the reported rate less than actual. Listen for world news and events that may have a major impact to the world economy like a major failure of the Chinese economy or failure of the European Union to maintain a strong economic base.

Thank you for reading our rants on the Federal Reserve System. We welcome any comments you might want to share below. If this website interests you, then share it with your friends.

The Redneck Economist, April, 2014